Driving for ridesharing apps like Uber or Grab is a growing segment of the “gig economy” or “gig work”. There are an estimated 10,500 individuals working for private-hire car services such as Uber and Grab, compared to around 200 000 primary and secondary freelancers. The gig economy is a growing area of interest for the Singapore government. In March 2017, Manpower minister Lim Swee Say announced the creation of a tripartite workgroup on “workable solutions” for the well-being of freelancers in Singapore.

This research paper contributes to the growing discussion of social protection for freelancers by focusing on the economic security needs of rideshare drivers. Having control over savings is critical to Singaporean rideshare drivers. Specifically, drivers need more flexible savings options. For such drivers, Singapore’s coordinated social security system could be enhanced by a technology-enabled saving mechanism option provided by online platforms observed in the US, such as Honest Dollar or Betterment.

This research is based on interviews with Singapore and US rideshare drivers, and a comparative analysis of US and Singapore social security systems. The author interviewed 68 Uber/Grab drivers in Singapore, looking at retirement security, adequacy of health insurance coverage, and union representation. The author also interviewed 70 drivers in the Washington Metropolitan area. The research paper goes into greater detail on the analysis of ridesharing drivers in the US.

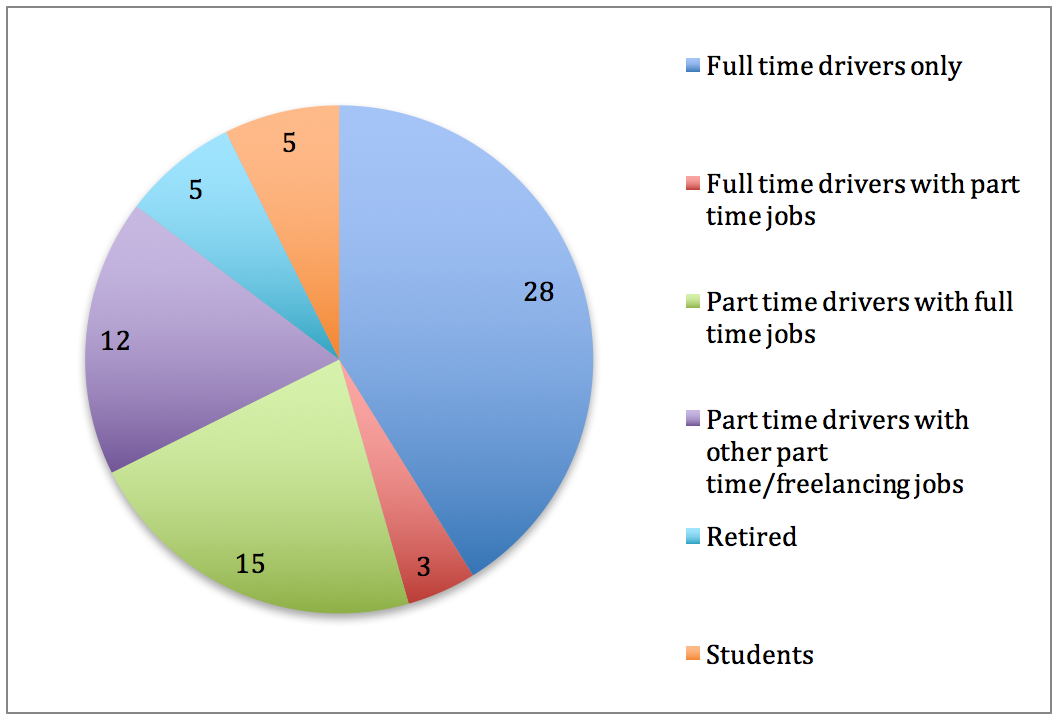

In Singapore, full-time drivers (those driving 8 hours or more) made up 41% of all interviewed drivers [See Figure 1]. Other demographic trends of Singaporean interview respondents include:

- 20 out of 28 full time Uber/Grab Singaporean drivers are above the age of 50. This 71% mirrors the age distribution of the employed resident taxi driver in Singapore in 2014, when about 8 in 10 taxi drivers were aged 50 and above.

- 29 out of 68 – around 43% of Uber/Grab Singaporean drivers interviewed have explicitly self-identified to have a history of self-employment, freelancing, part-time jobs.

Figure 1: Distribution of drivers’ employment status amongst 68 Singaporean respondents

The interviews revealed the following:

- Singapore drivers who had fewer savings in previous occupations generally continued the behavior. This is most evident amongst taxi-drivers. Many, if not all who have drove taxis before said that they were unable to save what they earned. In contrast, full-time drivers who used to work in a full time salaried job with fixed contributions to CPF make a concerted effort to set aside an equivalent amount from their Uber/Grab income.

- Regardless of their incomes, most drivers reported a need to drive longer hours to earn the same as before, resulting in health risks at work

- The barriers to entry may not be as low as commonly assumed. Some drivers with experiential knowledge and self-discipline are able to perform better.

- There are hidden costs that drivers may not have been aware of, including the car loan payment, or damages resulting from car accidents.

Overall, the majority of drivers for ridesharing apps do not plan to rely on CPF for retirement savings. Many who do contribute/have contributed to CPF do so for house payments – which also shows that the dilemma between home ownership, long-term retirement savings and short-term income security is even starker for this demographic. Given the volatile incomes earned by drivers, many prefer to have greater control over and access to their savings.

The study also contrasts available social security options open to rideshare drivers in Singapore to that in the US. Singapore’s consolidated and coordinated social security system aims for wide coverage of all workers compared to the social security system present in the US. However, technology-enabled social security options in the US have arisen in the last few years to better cater to the needs of different saver types. The latter points to a possible social security option for freelance drivers in Singapore.