BY NICK BUFFIE

As you may have heard, in the United States the rich pay more federal income taxes than the poor – both in dollar terms and as a share of income. This point is acknowledged by commentators on both the Right and Left, serving as a rare example of nonpartisan objectivity in an era of “fake news.”

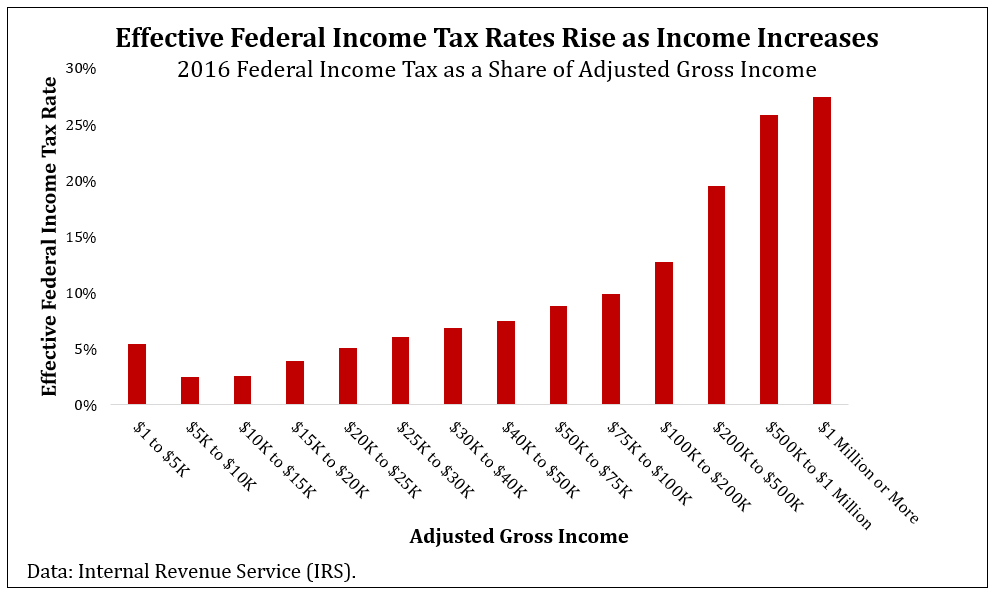

Although conservative think tanks and news outlets highlight this point somewhat selectively – federal income taxes account for just one-third of all tax revenue, and many other taxes fall disproportionately on lower-income Americans – it is, in a general sense, true:

In a general sense. As incomes rise, tax rates typically do as well; for example, Americans making between $5,000 and $10,000 face an average tax rate of just 2.4 percent, while those making between $200,000 and $500,000 pay an average rate of 19.4 percent.

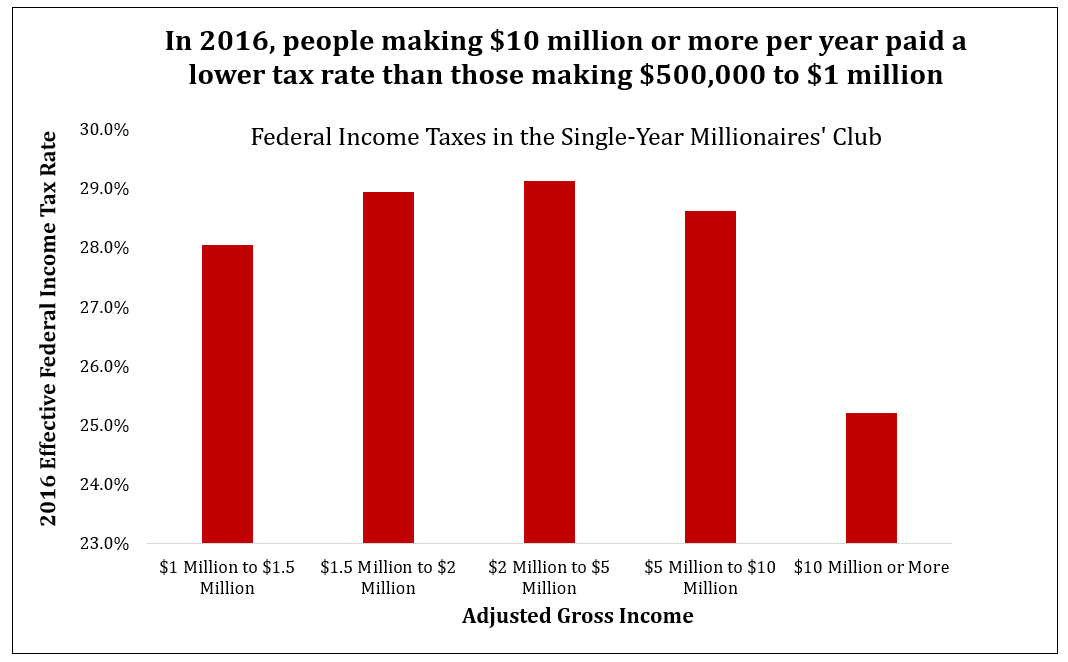

However, there is one odd exception to this rule: people who make over $5 million per year typically see their tax rate fall as they get richer. In 2016, Americans making $10 million or more paid an average federal tax rate of 25.2 percent, slightly lower than the 25.8 percent rate paid by people making between $500,000 and $1 million.

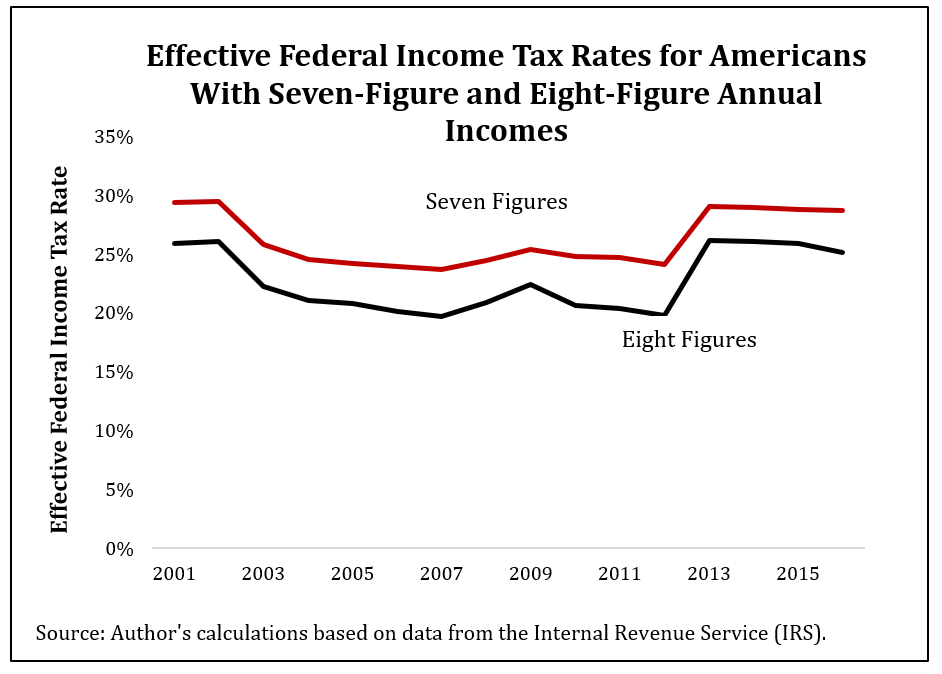

From 2001 to 2016, the average federal income tax rate paid by people making eight figures or more ($10,000,000+) was less than the rate for those making seven figures every single year:

During this time, Americans with seven-figure incomes paid an average federal income tax rate of 26.3 percent; those with incomes between half a million and $1 million paid an average rate of 25.0 percent, and those with eight-figure incomes paid a rate of 22.7 percent.

Why the discrepancy? If we generally believe that the best-off should pay the highest rates, why does this rule not apply to the richest of the rich?

The uber-wealthy are able to get away with a lower rate because they receive very little of their income from work. (That’s right: people who earn their money from work are taxed at a higher rate than those who don’t earn their money at all.)

In particular, dividends and long-term capital gains are taxed at a lower rate than other forms of income. Dividends are regular payouts that corporations make to their shareholders; capital gains are profits made from the sale of an asset above its purchase price. (For example, if you buy ten shares of a company for $30 and later sell those shares for $45, your “capital gain” is $15.) Capital gains on assets held longer than one year are given preferential treatment in the tax code.

This lower rate mostly benefits the aforementioned “richest of the rich.” And it benefits the richest of the richest of the rich even more: in 2014, the nation’s 400 highest-income taxpayers – who had an average income of $318 million – received about three-quarters of their income from dividend payments and long-term capital gains. Had they instead made their money by mining coal or laying brick, they would have been taxed at a higher rate.

The federal income tax is, for the most part, progressive. That is as it should be: those who are given the most by society ought to give the most back. Unfortunately, the federal income tax has a special exception for unearned income, and that exception mostly benefits the lucky few. If we don’t want to give a special tax break to people who make large sums of money by not working, we should begin taxing all forms of income equally.

Nick Buffie is a first-year Master’s in Public Policy student at the Harvard Kennedy School (HKS). Before coming to HKS, Nick spent three years working at two economic policy think tanks in Washington, DC. His research on health care reform, tax policy, labor markets, and other topics has been cited in the New York Times, the Washington Post, Meet the Press, National Public Radio, and other nationally syndicated media outlets.

Edited by Dave Hicks

Photo from Flickr