BY EDWARD CUIPA

On 16 December 2015, the US Federal Reserve announced the first increase in the federal funds rate in almost a decade, hiking the target benchmark rate range by 0.25 percentage points to 0.25–0.50 percentage points.[i] The move impacts economic growth because the federal funds rate sets the rate at which banks can lend to one another overnight, which in turn affects lending rates throughout the economy. Although the symbolic move may be viewed as a vote of confidence in the overall strength of the US economy, potential stumbling blocks abound.

Capital outflows, or sales of assets held by foreign investors and driven in part by the Federal Reserve’s move, have already reached significant levels: the Institute for International Finance (IIF) estimates that in 2015, emerging markets faced annual net capital outflows for the first time since 1988.[ii] A sharp reduction in emerging-market capital flows and the slowdown it entails would inhibit global growth, because according to the International Monetary Fund (IMF), emerging markets made up 56 percent of global gross domestic product (GDP) and 79 percent of global GDP growth over the five-year period from 2010 to 2015.[iii]

Interest rate markets in the United States currently forecast a more moderate pace of rate increases than projected by the Federal Reserve.[iv] And with rising political risks, stalling reform efforts, and falling commodity prices placing further headwinds on emerging-market growth, interest rate increases are occurring at an inopportune time. Given this economic backdrop, IMF Managing Director Christine Lagarde stated in December 2015 that “global growth will be disappointing and uneven in 2016.”[v] With all these negative factors, many fear that the Federal Reserve may even be forced to reverse course as growth stalls.

A Commodity Menace: China’s Economic Rebalancing and the Commodity Reversal

The persistent decline in commodity prices has worsened fiscal conditions in energy-producing nations. Low oil prices have mired markets in energy-producing developing countries, worsened fiscal budget imbalances, and increased the likelihood of social tensions as governments cut back on subsidies or benefits. The oil-producing countries of Azerbaijan and Kazakhstan have already taken action, abandoning their currency “pegs,” which fix exchange rates to the dollar, as their currency reserves dwindled and limited the ability of the central bank to defend a peg.[vi] The move to floating exchange rates eliminates the possibility of a speculative attack on the currency—this happens when traders bet the country will abandon the peg—which could severely impact growth and lead to high inflation.[vii]

Driving the decline in commodity prices are efforts by Chinese policy makers to shift China’s economy away from export- and credit-led growth toward one driven by consumer spending. Policy makers worsened sentiment when they adjusted the renminbi fixing mechanism in August 2015 to allow the currency to better reflect market and economic conditions, rather than dollar movements.[viii] The move stoked deflationary fears, as well as concerns that China, worried about growth prospects, was seeking to boost exports through currency depreciation.

These currency moves suggest intensifying pressure on governments in the emerging world to act. However, with increasingly integrated global financial markets, policy makers in open economies confront a “trilemma” in that they can simultaneously choose only two out of three conditions: free capital flows, an independent monetary policy, or a fixed exchange rate.[ix] Thus, when faced with a balance-of-payments crisis (which arises when foreign capital inflows, which financed current-account deficits that occur when the value of a country’s imports of goods and services exceeds the value of its exports, sharply reverse), policy makers in countries with free capital flows and adequate reserves can take two paths. One option is to finance a current-account deficit by selling foreign-exchange reserves, essentially delaying the needed rebalancing while supporting the domestic currency. Alternatively, policy makers can take action through expenditure-switching or expenditure-reducing policies.

Expenditure switching occurs when policy makers allow the domestic currency to depreciate, generally inducing consumers and firms to allocate a greater share of income to domestically produced goods at the expense of imports. Expenditure reduction occurs when officials tighten fiscal or monetary policy with the aim of reducing overall expenditures. The goal of both types of adjustments in this case is to improve the trade balance and decrease the price of domestic goods relative to foreign goods.[x] However, these measures are costly because currency depreciation can decrease domestic consumers’ purchasing power or increase dollar-denominated debt payments, while tighter fiscal policy can make corporate investment less attractive and reduce economic growth.

The Flow Awakens: Herding Behavior and the Search for Yield

Cross-border capital flows can be beneficial to both advanced and emerging economies if they increase the set of investments available to developed market investors and provide emerging markets access to lower-cost capital. However, the Mundell-Fleming model, which provides a framework to analyze exchange rates, interest rates, and output in an open economy, suggests that, holding all else equal, capital inflows are contractionary because they lead to currency appreciation in the country receiving inflows and a decrease in the country’s net exports. In addition, different forms of capital flows react to macroeconomic events asynchronously, with investor portfolio flows more transitory or short term in nature than foreign direct investment. Nevertheless, recent research by Olivier Blanchard et al. at the IMF shows that non-bond capital inflows tend to be expansionary in practice; inflows lead to reduced costs of capital, increased investment, and higher rates of growth.[xi] Thus, capital inflows can help countries receiving them finance growth-inducing investment.

So what’s the catch? The IMF’s October 2015 Global Financial Stability Report highlighted that global “push” factors, as opposed to country- or firm-specific “pull” factors, have been the driving force behind increased debt issuance in the emerging world.[xii] Unconventional monetary easing by major developed-market central banks makes it likely that as interest rates in advanced economies increase, emerging markets could face a prolonged period of capital outflows and increased financing costs.

In the wake of the global financial crisis, the Federal Reserve, through large-scale asset purchases called Quantitative Easing (QE), sought to maintain low real, or inflation adjusted, interest rates in order to help decrease real debt burdens. However, QE altered the behavior of institutional investors. In the hunt for higher returns in assets considered to be more volatile, investors allocated greater portfolio shares to assets in emerging markets. The ongoing unconventional monetary policy led to herding by institutional investors as they collectively chased higher returns. This can prove problematic and lead to adverse financing conditions when investors unwind their positions.

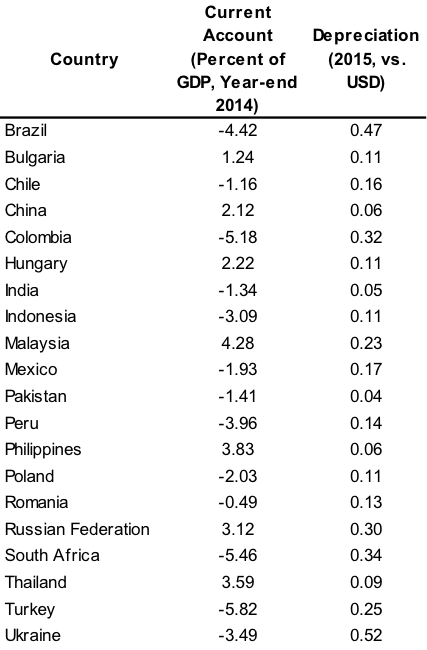

In anticipation of Federal Reserve rate hikes, emerging-market currencies faced an onerous environment in 2015. To get a sense of the magnitude of currency depreciations over the course of the year, Table 1 below lists the current account as a percentage of GDP at the end of 2014 and currency depreciation for twenty emerging markets over 2015.[xiii] Since the foreign exchange rates are measured in terms of domestic currency versus USD, a positive value of depreciation indicates that the currency weakened. The data show that the currencies of countries that started 2015 with higher current-account deficits faced more severe depreciation on average. This pattern is similar to trends seen during the “taper tantrum” in 2013 when Federal Reserve Chairman Ben Bernanke merely suggested that the Federal Reserve may begin to slow down the pace of its asset purchases.[xiv] In the wake of the announcement, emerging-market currencies sold off dramatically and risk aversion quickly spread.[xv] The “fragile five,” a group of emerging-market countries (Brazil, India, Indonesia, South Africa and Turkey) with high current-account deficits and a reliance on foreign capital inflows, faced particularly severe outflows and currency depreciation.[xvi]

Table 1: Current Account and Exchange Rate Changes

Source: International Financial Statistics, International Monetary Fund

Return of the Debtor: Dollar-Denominated Risks

To be sure, not all inflows portend future turbulence as the Federal Reserve raises rates. In fact, there has been a positive trend of increased issuance of local-currency bonds—that is, bonds denominated in domestic currency—by emerging-market sovereigns. As a result, it seems that many emerging-market governments have escaped the problem of “original sin,” whereby emerging markets struggle to issue sovereign debt denominated in their own currency.[xvii] In fact, Moody’s Investors Services estimates that local-currency sovereign debt issued by emerging-market governments has increased substantially since the global financial crisis, with the average local-currency share of sovereign debt rising from around half at the turn of the millennium to about three-quarters in 2014.[xviii] This caused emerging-market local-currency sovereign debt to increase an average of 14.4 percent annually.[xix] Compared to USD-denominated debt, local-currency debt helps protect issuers from sharp appreciation of the dollar and reduces “currency mismatches,” or unhedged dollar exposures.

In the private sector, the growth in overall emerging-market corporate debt has been immense, with the IMF estimating that it has risen from $4.0 trillion in 2004 to more than $18.0 trillion in 2014.[xx] Moreover, there has been a sharp increase in the issuance of dollar-denominated debt. Indeed, offshore dollar credit—that is, USD-denominated debt of issuers based outside of the United States, and which includes bonds and loans—has risen from 28 percent to 54 percent of US GDP and from 11 percent to 16 percent of global GDP (excluding the United States) over the past decade.[xxi] Furthermore, emerging-market corporate debt issued by non-financial firms and denominated in USD, yen, and euro rose from $1.8 trillion in 2010 to about $3.0 trillion in 2014.[xxii] With QE in the United States, dollar bond issuance has been matched by demand as investors in advanced economies chased higher yields in the emerging world.[xxiii] As a result, some corporations may be exposed to latent balance sheet imbalances from unhedged dollar-debt exposure as the Federal Reserve hikes rates and the dollar continues to rise (see Figure 1). Simply put, a rising dollar makes the dollar-debt payments of firms in emerging-market more burdensome.

Figure 1: Trade-Weighted U.S. Dollar Index

Note: The trade-weighted US dollar index is calculated as a weighted average of the foreign exchange value of the US dollar against the currencies of a broad group of major US trading partners. Source: Federal Reserve Bank of St. Louis.

Liquidity is another consideration that is vital for the efficient functioning of markets, since high levels of liquidity allow investors to transact without significantly impacting market prices. However, deleterious liquidity conditions in bond markets could also boost volatility in a sharply risk-averse environment. Indeed, many market commentators believe that the Volcker Rule, part of the Dodd-Frank financial reform bill that prohibits federally-insured banks from taking proprietary positions in the market, has led to sharp reductions in bond inventory held on the balance sheets of primary dealers (that is, firms that serve as market-makers for bonds). This decline in inventory may lead to yield spikes when market sentiment shocks occur.[xxiv] Consequently, increasing interest rates and an appreciating dollar could heighten liquidity shocks and price jumps if investors exit emerging-market risk en masse.

A New Hope: Improved Safeguards?

The risks of an overreliance on cross-border capital flows highlights the need for global institutions that can provide adequate financing measures in the event of financial contagion—situations when a crisis in one country spreads to seemingly unrelated markets. However, given its legal mandate to target domestic inflation and employment, the Federal Reserve has a limited role to play. To be sure, the Federal Reserve can offer currency swap facilities, in which the Federal Reserve provides USD to emerging-market central banks in exchange for foreign currency when dollar-financing runs dry. However, these swaps are only offered on a case-by-case basis.[xxv] And although the Federal Reserve referenced global economic and financial developments when it decided not to raise rates in September of 2015, political and legal constraints essentially limit the Federal Reserve’s ability to address financial instability outside of US markets unless it directly impacts domestic economic conditions.

Many emerging-market countries, however, have improved safeguards since the Asian financial crisis of 1997, primarily by boosting foreign-exchange reserves and moving from fixed- to floating-currency regimes.[xxvi] This, in turn, makes emerging-market policy makers better positioned to adjust in times of financial crises. For example, foreign-exchange reserves in developing economies have risen 60 percent between 2008 and 2014, from $4.8 trillion to $7.7 trillion.[xxvii] As a result, in the event of a currency crisis, policy makers may have more room to finance current-account deficits and defend their currencies by selling foreign-exchange reserves. Moreover, in 2010, members of the Association of Southeast Asian Nations, along with China, Japan, and South Korea, formulated the Chiang Mai Initiative Multilateralization Agreement, which now pools together $240 billion in foreign-exchange reserve.[xxviii] The initiative could theoretically allow for countries to access pooled reserves through dollar currency swaps in the event of a short-term liquidity crisis and ease financial strains.[xxix]

Despite these measures, there is currently no global lender of last resort with adequate firepower to combat global financial crises. This reveals the importance of improving the effectiveness of multilateral institutions in addressing global financial contagion. However, in the years since the global financial crisis, we have witnessed sclerotic progress in efforts to expand and reform preexisting multilateral institutions. As a result, many countries have supported the development of institutions, including the BRICS New Development Bank and the Asian Infrastructure Investment Bank (AIIB) spearheaded by China, that exist outside of the Bretton Woods framework that gave birth to the IMF and World Bank. Even Western allies of the United States, against the wishes of the Obama administration, backed the AIIB.[xxx]

Fortunately, some progress has been made on this front. In December 2015, Congress passed an omnibus spending bill that included IMF reform doubling the quota share, or permanent equity funding, and allocating a greater voting share to emerging-market countries.[xxxi] Moreover, the IMF recently softened its view on capital controls, or measures that limit inflows and outflows of investor funds, and suggested that capital controls may be optimal in emerging markets if regulatory and financial institutions have not reached an adequate level of development.[xxxii] However, to effectively guard against financial instability, a better path would be for emerging-market policy makers to maintain fiscal and monetary prudence and develop more robust regulatory regimes. Countercyclical policies that boost reserves and increase savings during periods of growth would grant policy makers the flexibility to increase spending during sharp declines in growth and investor sentiment across markets.[xxxiii]

More recently, IMF officials have discussed new crisis-fighting mechanisms. In a 2016 speech, Christine Lagarde suggested that the IMF may develop short-term crisis credit lines for emerging market governments that face liquidity problems but are otherwise solvent. [xxxiv] However, a recent Wall Street Journal article pointed out that with only about $400 billion in available bailout funds, the IMF has limited financial resources in a world with trillions of dollars of cross-border capital flows.[xxxv] Another interesting proposal by Edwin Truman, Senior Fellow at the Peterson Institute for International Economics, calls for an arrangement in which the IMF and a global network of central banks would decide, based on predefined criteria, when central banks should provide currency swaps during periods of global financial contagion.[xxxvi]

Conclusion

Given the prolonged period of inflows into emerging markets, the region may be vulnerable to sharp capital flight and bouts of contagion as the Federal Reserve continues to normalize interest rates. Indeed, since emerging-market debt has grown at a rapid pace after the global financial crisis, capital will likely continue to flow out of emerging markets as higher US short-term rates and a stronger dollar dampen sentiment. Moreover, new regulations like the Volcker Rule could make volatility spikes more likely since primary dealers have stepped back, reducing liquidity in the corporate bond markets.

With sharply lower energy prices and deteriorating fiscal positions in many emerging-market oil-producing countries, unforeseen geopolitical shocks have the potential to lead to contagion. Furthermore, the rising disparity between the wages of high- and low-skilled employees could continue to boost populist politicians who advocate protectionist policies in the Western world, including the United States and European Union. As a result, protectionism is a potential long-term threat that could lead to a sustained decline in global trade and economic growth. Despite these risks, emerging markets can be better prepared for crises of the future through continued efforts to build more efficient multilateral mechanisms that can address sharp capital outflows and domestic reforms that lead to countercyclical fiscal policies and an improved mix of equity and debt financing.

Photo Credit: Day Donaldson via Flickr Creative Commons

[i] “Fed Raises Rates in Historic Move,” Financial Times, 17 December 2015, http://www.ft.com/intl/cms/s/0/46a9001a-a424-11e5-8218-6b8ff73aae15.html#axzz41Pp18upw.

[ii] “Stressful Times,” The Economist, 5 December 2015, http://www.economist.com/news/finance-and-economics/21679465-problems-banks-developing-world-are-more-chronic-acute-stressful.

[iii] “The Global Economy in 2016,” The International Monetary Fund, accessed 2 January 2015, http://www.imf.org/external/pubs/ft/survey/so/2016/INT010416A.htm.

[iv] Greg Robb, “Traders Seem Certain Federal Reserve Won’t Raise Interest Rates Again This Year,” MarketWatch, 20 January 2016, http://www.marketwatch.com/story/fed-now-seen-as-one-and-done-in-2016-2016-01-20.

[v] Michelle Martin, “Global Growth Will Be Disappointing In 2016 – IMF’s Lagarde,” Reuters, 30 December 2015, http://www.reuters.com/article/imf-lagarde-idUSKBN0UD0JI20151230.

[vi]“Azerbaijan Abandons Currency Peg, Floats Manat,” Financial Times, 21 December 2015, http://www.ft.com/fastft/2015/12/21/azerbaijan-abandons-currency-peg-floats-manat.

[vii] Jeffrey Frankel, “Exchange Rate and Monetary Policy for Kazakhstan in Light of Resource Exports,” Harvard Kennedy School, 1 December 2013, http://www.hks.harvard.edu/fs/jfrankel/KazakhExRate-Mon2013Dec.docx.

[viii]“The Curious Case of China’s Currency,” The Economist, 11 August 2015, http://www.economist.com/blogs/buttonwood/2015/08/markets-and-economics.

[ix] Maurice Obstfeld and Alan M. Taylor, “The Great Depression as a Watershed: International Capital Mobility over the Long Run,” NBER Working Paper no. 5960 (1997), http://www.nber.org/papers/w5960.pdf.

[x] Stefanie Walter, Financial Crises and the Politics of Macroeconomic Adjustments, (New York: Cambridge University Press, 2015), 6-7, http://www.cambridge.org/us/academic/subjects/politics-international-relations/political-economy/financial-crises-and-politics-macroeconomic-adjustments.

[xi] Olivier Blanchard, Jonathan D. Ostry, Atish R. Ghosh, and Marcos Chamon, “Are Capital Inflows Expansionary or Contractionary? Theory, Policy Implications, and Some Evidence,” IMF Working Papers 15, no. 226 (2015), https://www.imf.org/external/pubs/ft/wp/2015/wp15226.pdf.

[xii] “Chapter 3: Corporate Leverage in Emerging Markets—A Concern?” Global Financial Stability Report (2015): 83,

https://www.imf.org/External/Pubs/FT/GFSR/2015/02/pdf/c3_v2.pdf.

[xiii] “International Financial Statistics,” The World Bank, accessed 04 January 2016, http://data.worldbank.org/indicator/DT.DOD.DPNG.CD.

[xiv] Landon Thomas Jr., “’Fragile Five’ Is the Latest Club of Emerging Nations in Turmoil,” The New York Times, 28 January 2014, http://www.nytimes.com/2014/01/29/business/international/fragile-five-is-the-latest-club-of-emerging-nations-in-turmoil.html?_r=0.

[xv] Landon Thomas Jr., “’Fragile Five’ Is the Latest Club of Emerging Nations in Turmoil,” The New York Times, 28 January 2014, http://www.nytimes.com/2014/01/29/business/international/fragile-five-is-the-latest-club-of-emerging-nations-in-turmoil.html?_r=0.

[xvi] Ibid.

[xvii] Barry Eichengreen and Ricardo Hausmann, “Exchange Rates and Financial Fragility,” NBER Working Paper, no. 7418 (1999), http://www.nber.org/papers/w7418.pdf.

[xviii] “Dramatic Rise in Local Currency Sovereign Debt Issuance Reduces Emerging Market Countries’ Vulnerability to Shocks,” Moody’s Investors Service, 1 September 2015, https://www.moodys.com/research/Moodys-Dramatic-rise-in-local-currency-sovereign-debt-issuance-reduces–PR_333713.

[xix] “Ibid.

[xx] Ian Talley, “IMF Flashes Warning Lights for $18 Trillion in Emerging-Market Corporate Debt,” The Wall Street Journal, 29 September 2015, http://blogs.wsj.com/economics/2015/09/29/imf-flashes-warning-lights-for-18-trillion-in-emerging-market-corporate-debt/.

[xxi] “Thrills and Spills,” The Economist, 28 September 2015, http://www.economist.com/news/special-report/21668717-america-centre-global-monetary-disorder-thrills-and-spills.

[xxii] Christine Lagarde, “The Case for a Global Policy Upgrade,” 12 January 2016, http://www.imf.org/external/np/speeches/2016/011216.htm?hootPostID=7330cb831c52f32619aafb5db5a503f5#P66_6547.

[xxiii] Robert N. McCauley, Patrick McGuire, and Vladyslav Sushko, “Global Dollar Credit: Links to US Monetary Policy and Leverage,” BIS Working Papers no. 483 (2015): 3, http://www.bis.org/publ/work483.pdf.

[xxiv] Yalman Onaran and Dakin Campbell, “Did Bank Rules Kill Liquidity? Volcker, Frank Respond,” Bloomberg, 20 October 2014, http://www.bloomberg.com/news/articles/2014-10-20/did-bank-rules-kill-liquidity-volcker-frank-respond.

[xxv]“The Spread of Central Bank Currency Swaps Since the Financial Crisis,” Council on Foreign Relations, http://www.cfr.org/international-finance/central-bank-currency-swaps-since-financial-crisis/p36419#!/?cid=from_interactives_listing.

[xxvi]“Currency Crises in Emerging Markets,” Council on Foreign Relations, 28 October 2015, http://www.cfr.org/emerging-markets/currency-crises-emerging-markets/p31843.

[xxvii] “Currency Composition of Official International Foreign Exchange Reserves (COFER),” The International Monetary Fund, accessed 04 January 2016, http://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4&ss=1408206195757.

[xxviii] “Chiang Mai Initiative,” Wikipedia, 15 December 2015, https://en.wikipedia.org/wiki/Chiang_Mai_Initiative.

[xxix] Ibid.

[xxx] Geoff Dyer, “US Attacks UK’s ‘Constant Accommodation’ With China,’ The Financial Times, 12 March 2015, http://www.ft.com/intl/cms/s/0/31c4880a-c8d2-11e4-bc64-00144feab7de.html#axzz3ymehAiPG.

[xxxi] Andrew Mayeda, “Congress Approves IMF Change in Favor of Emerging Markets,” Bloomberg, 18 December 2015, http://www.bloomberg.com/news/articles/2015-12-18/congress-approves-imf-changes-giving-emerging-markets-more-sway.

[xxxii] “IMF Adopts Institutional View on Capital Flows,” The International Monetary Fund, 3 December 2012, http://www.imf.org/external/pubs/ft/survey/so/2012/POL120312A.htm.

[xxxiii] Jeffrey Frankel, Carlos A. Vegh, and Guillermo Vuletin, “Fiscal Policy in Developing Countries: Escape from Procyclicality,” VOXEU, 23 June 2011, http://www.voxeu.org/article/how-developing-nations-escaped-procyclical-fiscal-policy.

[xxxiv] Ian Talley, “Emerging-Market Turmoil Spurs IMF Call for New Crisis Financing,” The Wall Street Journal, 12 January 2016, http://blogs.wsj.com/economics/2016/01/12/emerging-market-turmoil-spurs-imf-call-for-new-crisis-financing/.

[xxxv] Ibid.

[xxxvi] Edwin M. Truman, “The Global Financial Safety Net Needs Better Tools to Cope with Future Crises,” Peterson Institute for International Economics, 10 September 2013, http://blogs.piie.com/realtime/?p=3989%20%28http://blogs.piie.com/realtime/?p=3989.